An item that's exchanged or sold from a party in one nation to a party in another nation is an export from the originating nation, and an import to the nation accepting that item. Trading globally may allow customers and nations the opportunity to be exposed to new markets and items.

Importing raw materials and merchandise is one of the ways of increasing the benefit margins. The importer can have the much cheaper items from the outside market due to low labor cost, low charges etc. in terms of quality, the importer can have the higher quality merchandise. An importer can get to the regionally exclusive assets and cheap labor for creating the products. These resources are required within the fabricating process that have specialized skills and can be found in certain nations. For example, in electronic things, Japanese individuals are exceedingly productive and manufacturers in UK utilize the expertise from Japanese showcase for creating merchandise.

There's low investment requirement in exporting of products than the other modes of international exchange and extension of such foreign direct investment.

The first step to get into import export market is the license to trade. The below steps explain the procedure to acquire import export (IEC) license in India.

Import Export License:If you want to do international trade i.e. Import/ Export business, import Export License is mandatory. You have to apply for import Export code through Directorate general of foreign trade (DGFT) portal.

The Import Export Code is issued by The Director General of Foreign Trade, and it is basically a 10-digit code that's substantial for the lifetime of the trade. Importers will not be permitted to import commodities if they don't have the Import Export Code, and exporters will not be able to claim export benefits unless they have an Import Export Code.

Import Export License will be required:

- In custom clearance of imported good and for exporting product

- In Bill of Exchange & for receiving payment of exported product from bank

Basic instructions to be followed:

- Firm’s name, Date of incorporation should be same as per Firm’s PAN.

- Name of Director and Date of birth should be same in both Aadhar card and PAN card. These details will be verified real-time from the CBDT database/ NSDL.

- Account holder name should be same as Firm’s Name. Bank details will be verified with the Public Financial Management System.

- For Aadhar-e-sign in last step, use virtual id or Aadhar number of Firm’s Employer.

Steps

- First of all, you have to register on the portal for that you would require,

- Valid email Id and mobile number,

- Continue internet connectivity.

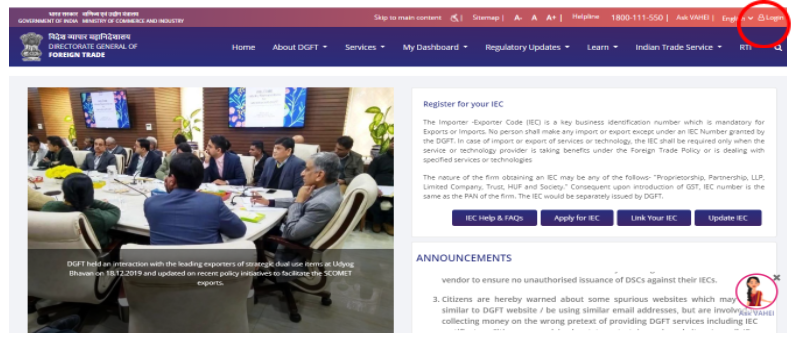

- You have to Click on Login available on the right corner of DGFT portal.

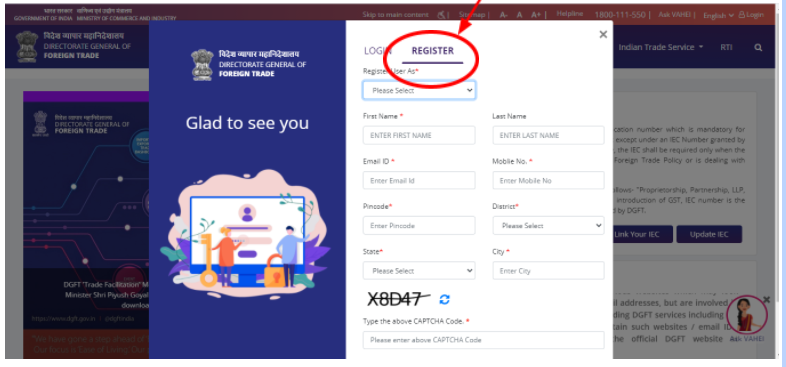

- Select register and Enter the registration details.

- After receiving OTP on given mobile no and mail id, enter into given block and complete registration process.

- You will receive a mail containing temporary password. Please reset password on your first login.>

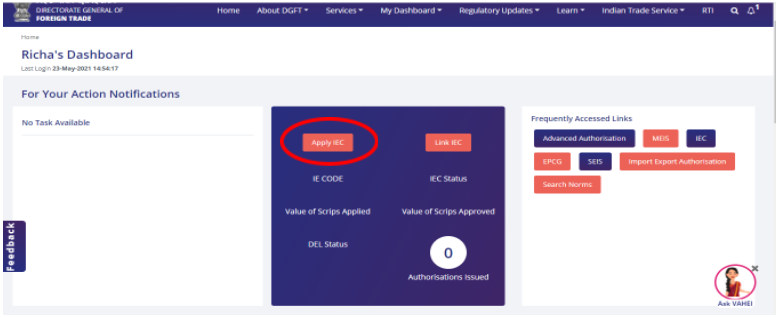

- After login click on Apply IEC.

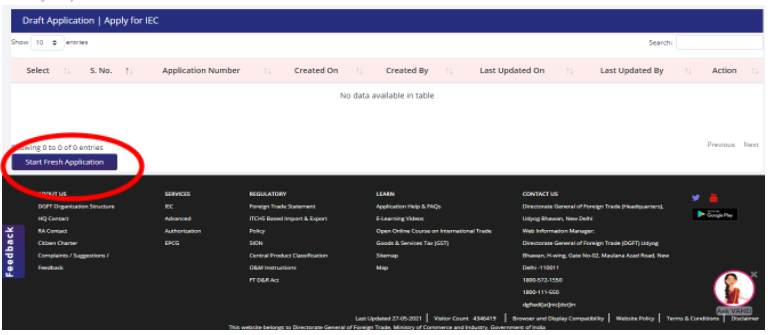

- You can proceed with start fresh application or with existing application if you have saved draft

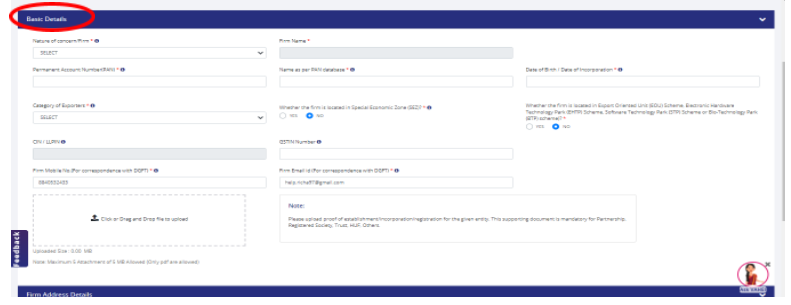

- Fill all required details in the General Information Segment. All the Mandatory areas have been checked with a Ruddy Bullet (*). The Draft will only be saved in case the Required details within the “Basic Details” Area and “Firm Address Details” Area.

- Nature of concern/ firm

- Firm name (as per PAN)

- Firm’s PAN

- Date of incorporation

- Category of exporter

- Firm Mobile No. (For correspondence with DGFT)- will be verified sending by OTP. It can be updated.

- Firm email id (For correspondence with DGFT)- will be verified sending by OTP. It can be updated.

- GSTIN

- LLPIN/CIN

- proof of establishment/incorporation/registration for the given entity. This supporting record is required for Partnership, Registered Society, Trust, HUF, Others.

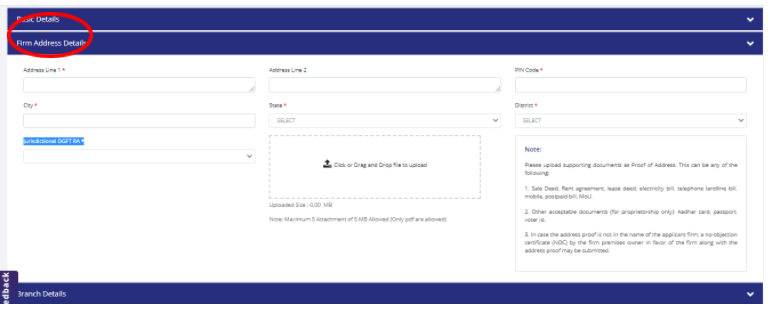

- Firm address

- Address

- Pin code

- City

- State

- District

- Jurisdictional DGFT RA (will be selected automatically)

- address proof: This can be any of the following.

- Sale Deed, rent agreement, lease deed, electricity bill, telephone landline bill, mobile, postpaid bill, MoU.

- Other acceptable documents (for proprietorship only): Aadhar card, passport, voter id.

- In case the address proof isn't in the name of the candidate firm, a no-objection certificate (NOC) by the firm premise’s owner in favor of the firm in conjunction with the address proof may be submitted.

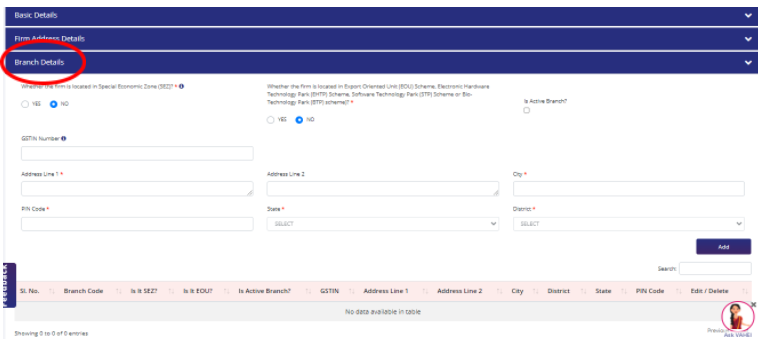

- Branch details if any

- Enter GSTIN number,

- Address-

- City,

- Pin code of the branch(es) linked with the above importer exporter code.

- After filling all mandatory details. Click on Save and NEXT (given in the bottom right corner). You will move to the next section.

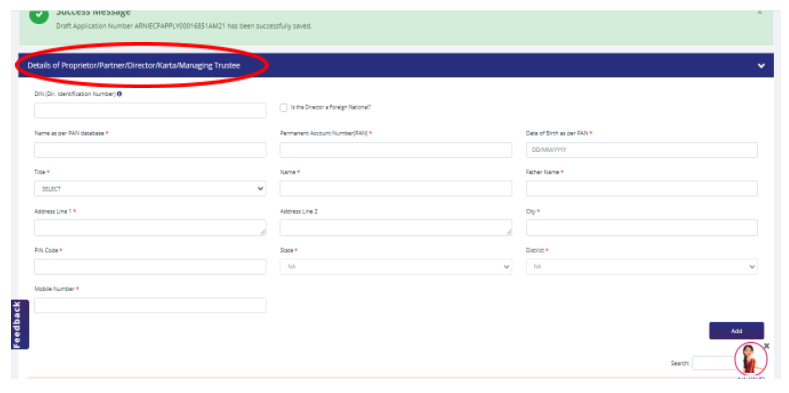

- Details of proprietor/partner/ Director/Karta/Managing Trustee” Section

- PAN (director)

- Name (As per PAN Database)

- Date of Birth

- Enter Name,

- Father Name

- Address

- Mobile number

- If the Director is a foreign national, tick the check box.

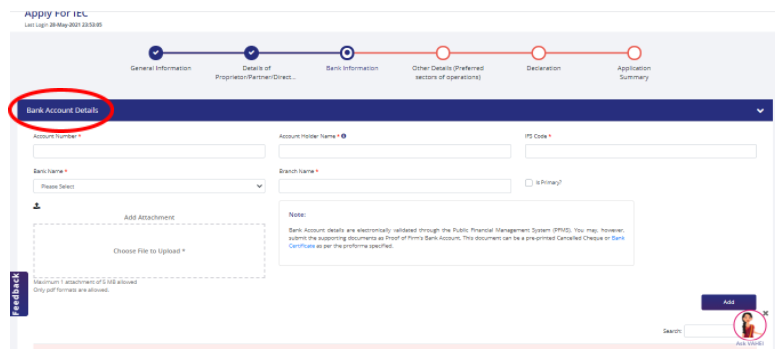

- Bank details- Required details are as follows:

- proof of firm’s bank account

- Account Number

- Account Holder Name- The Account Holder name should be same as Firm Name.

- IFSC code

- Bank Name

- Branch Name

- cancelled cheque(proof)/ bank Certificate.

- Other Details (Preferred sectors of operations)

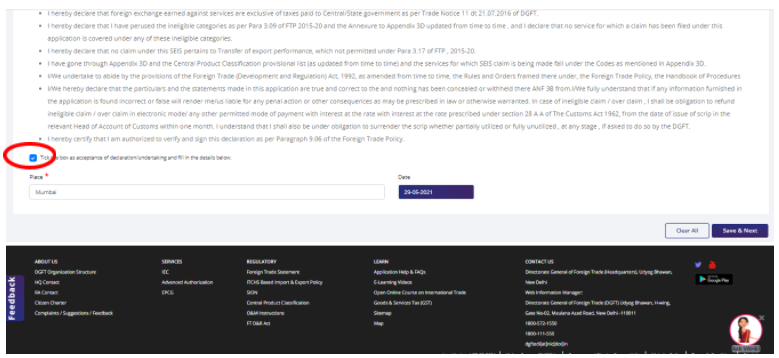

- Read and accept the declaration.

- Tick the box as acknowledgment of declaration/undertaking and fill in the details below.

- Fill place and Date.

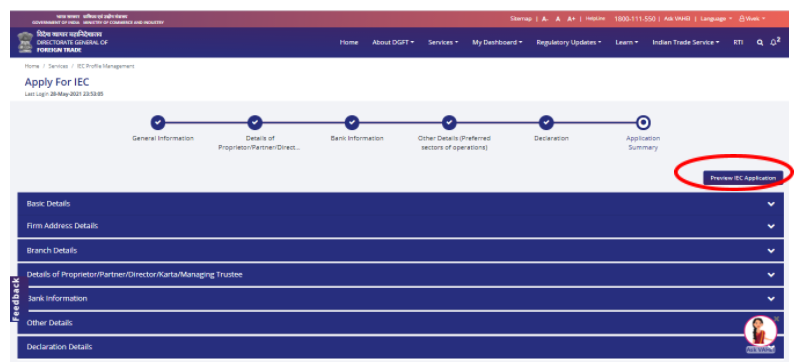

- Check the Application Summary

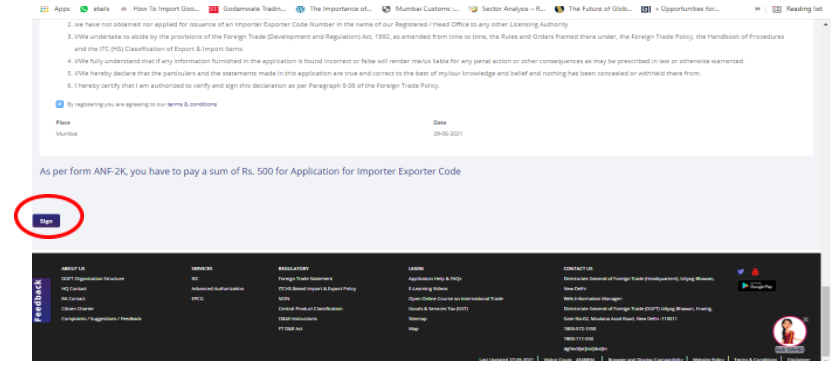

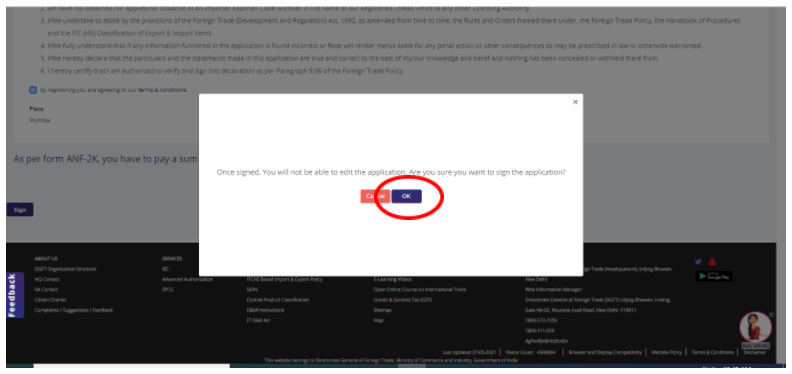

- click on Sign option to sign the application using digital token or Aadhaar.

- Select Ok and you will be directed to next page with the signing option.

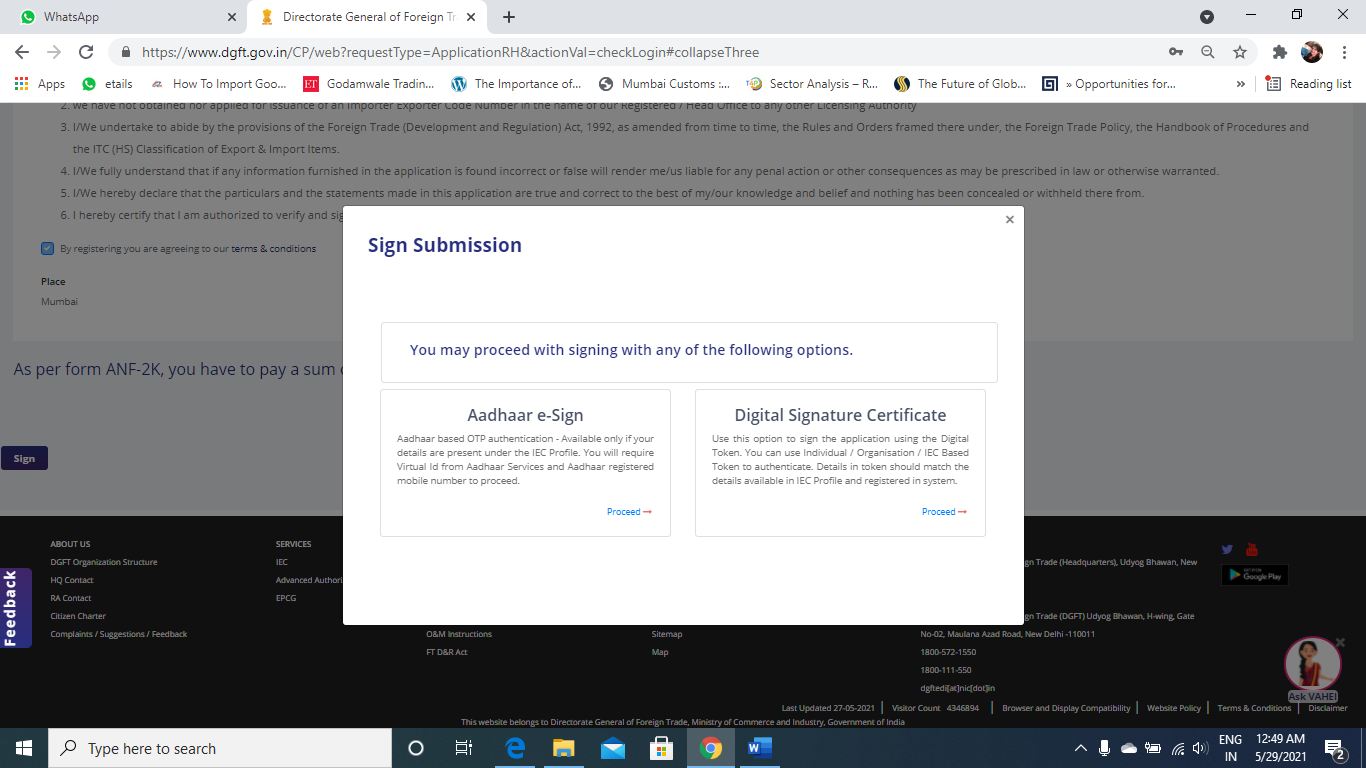

- You will get two options to sign the appliction form, one is through Aadhar-e-sign and second is through digital signature certificate. Proceed with any one option as per your convenience for signing the application form.

- If you are opting for Aadhar-e- sign,

- A window will open for Aadhar Based e-Authentication on outside site.

- Enter your virtual id or Aadhar number and tap Get OTP button.

- You may get OTP on your number enrolled with Aadhar office.

- Enter OTP and tap on submit button.

- After signing the application, Confirm and proceed to make the payment against application.

These are required details :

Enter all required details in this area. DIN (Dir. Identification Number) is auto brought from Service of External Affairs based the CIN number gives over in general information area.

If there is more than one director in affirm you can choose one from below and can update their details.

After filling all required details, click on Save and Next, you will move to the next section.

After filling all required details, click on Save and Next, you will move to the next section

Select the reason answering the question “Why you are applying for IEC or where this IEC will be utilized”.

Preview of IEC application will be available and you can tally all your details as after signing the application you would not be able to make changes.

For Payment you will be redirected to Payment Gateway (Bharatkosh).

The user will receive the IEC Certificate in the email and if required the User can download the IEC Certificate after login the DGFT Website and using “Print Certificate” feature in “Manage IEC”.

This blog is written by Richa Singh and she is currently pursuing her MBA from NITIE National Institute of Industrial Engineering (NITIE). She has written this blog based on her first hand experience of applying for an IEC license as part of Internship at Godamwale.

Godamwale is tech enabled warehousing and fulfillment company which provides flexible warehousing which can be of great help from importers/exporters as they need short term storage. Godamwale’s warehouses are based near all major ports and with their pay per use model without any long term contracts can help importers and exporters cut down their logistics cost and increase their revenue by positioning their inventory near to port and consumption markets. We have our presence in 148 cities of india.